carried interest tax proposal

Carried Interest Raises 141 billion. Maryland proposes tax on carry management fees.

Doing Business In The United States Federal Tax Issues Pwc

Benefits of the Carried Interest Legislative proposals to reduce or eliminate the tax benefits of the Carried Interest have failed on several occasions in the last 10 years including in 2017 3 year holding period rather than 1 year to obtain long-term capital gain treatment Holding period applies to sale of Carried Interest.

. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed legislation would close the entire carried interest loophole re-characterization of income from wage-like income to lower-taxed investment income and deferral of tax payments It further states that other versions of carried interest legislation.

The proposed Ending the Carried Interest Loophole Act S. Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. The proposal would generally extend the three-year holding period required for carried interest to be taxed as a capital gain as opposed to ordinary income to five years.

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. The bill contains some anticipated proposals as well as a few surprises of particular interest to Private Equity funds. On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole Act or the Proposal that would substantially change the US.

On 7 August 2020 the Financial Services and the Treasury Bureau issued a proposal to provide tax concession for carried interest arising from eligible private equity PE funds subject to specified conditions. The proposed changes to the carried interest rules in section 1061 could significantly limit favorable tax treatment of carried interests for high-earner PEVC professionals. Carried-Interest Tax Break Shrinks Survives in Democrats Plan.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe Bidens social spending plans one tax break popular among major Democratic Party donors was left in placethe taxation of carried interest income at the lower capital gains rate. However carried interest attributable to a real property trade or business would retain a three-year holding period requirement.

Proposal to provide tax concession for carried interest distributed by eligible private equity funds. Carried Interest Tax Proposal Threatens Charitable Giving. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration.

The proposal includes a transitional rule that allows a partner with a carryforward excess business interest expense amount under the current rules to treat such amount as paid or accrued in the partners first tax year beginning after December 31 2021. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper.

Nevertheless under a limited look-through rule provided for by the Proposed Regulations even if the partner has held the carried interest for more than three years before selling it all or a portion based on specified rules of the partners gain from the sale of its carried interest will still be treated as short-term capital gain under Section 1061 if 80 or more of the. Federal income tax treatment of partnership interests issued in exchange for services commonly known as carried interests. Corporations licensed under Part V of the Securities and Futures Ordinance or an authorized financial institution registered under Part V for carrying on business in any regulated activity as defined in Part 1 of Schedule.

Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is treated under the tax code. Chairman Camps proposal to tax certain carried interest as ordinary income differs from prior legislative proposals. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats.

This proposal can be analogized to a related-party loan although loan. Others argue that it is consistent with the tax treatment of other entrepreneurial income. Some view this tax preference as an unfair market-distorting loophole.

14 Sep 2021 0. Bloomberg -- House Democrats want to restrict the use of a prized private-equity tax break to help fund President Joe Bidens economic agenda but their proposal falls short of eliminating the carried-interest provision criticized by some members from both political parties. Carried interest is very generally a share of the profits in a partnership paid to its manager.

The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by. But in reality the tax as proposed in the administrations plan would impact partnerships of all sizes including those with individual partners earning less than the. The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a perk for private equity.

Furthermore the Proposal clarifies that 100 of eligible carried interest would also be excluded from the employment income for the calculation of the investment professionals salaries tax.

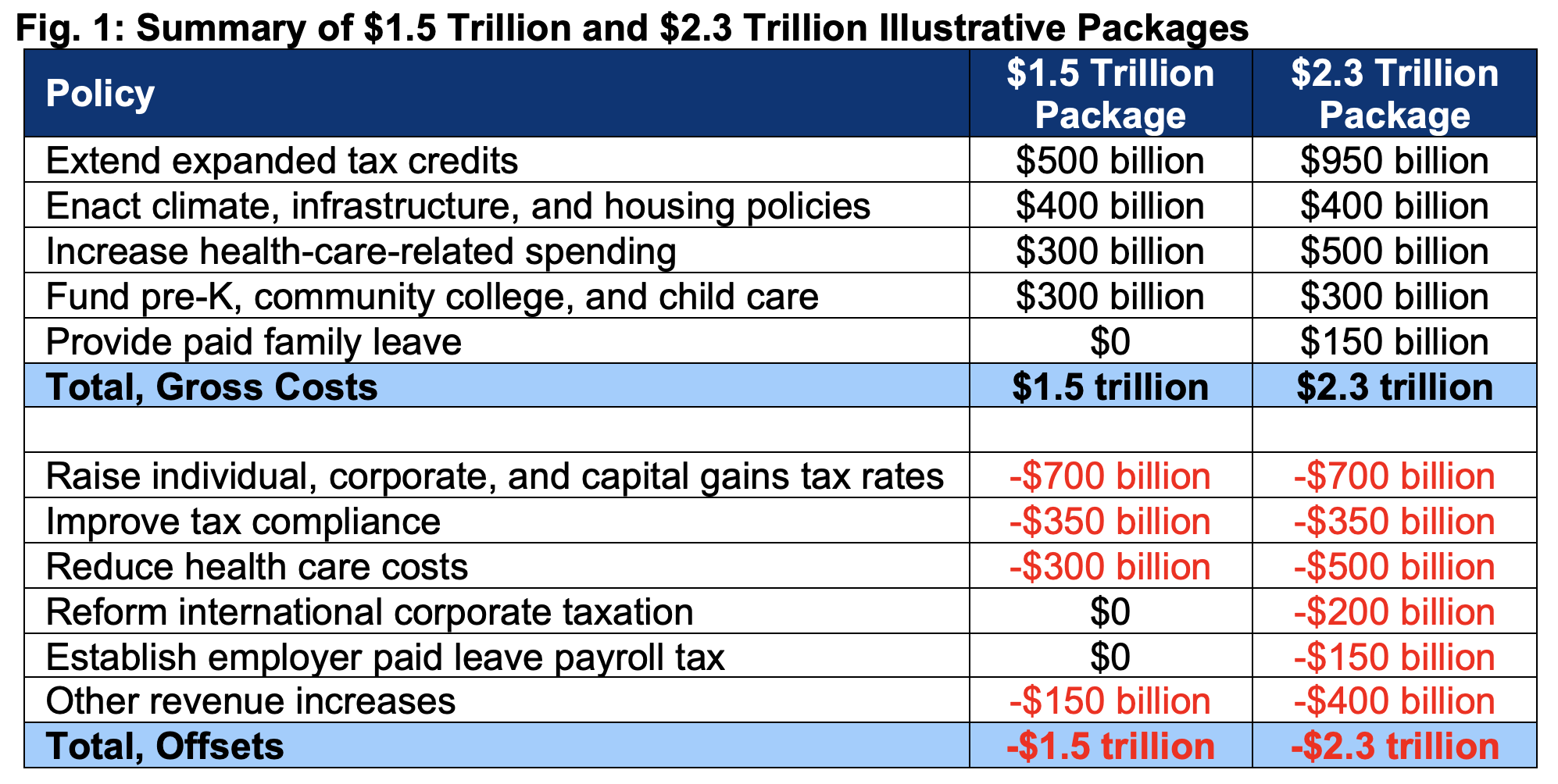

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Partnership Agreement Templates Free Design Templates Rental Agreement Templates

What Are The Consequences Of The New Us International Tax System Tax Policy Center

How Should Progressivity Be Measured Tax Policy Center

Partnership Agreement Template Real Estate Forms Agreement Sales Template Templates

The Relationship Between Taxation And U S Economic Growth Equitable Growth

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Ms Excel Business Services Receipt Template Receipt Template Templates Estimate Template

Income Tax Increases In The President S American Families Plan Itep

Tax Proposals Under The Build Back Better Act Version 2 0

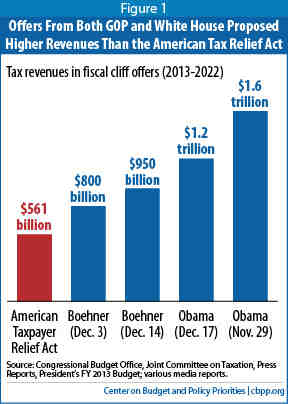

Tax Expenditure Reform An Essential Ingredient Of Needed Deficit Reduction Center On Budget And Policy Priorities

Moving Toward More Equitable State Tax Systems Itep

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How Should Progressivity Be Measured Tax Policy Center

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center